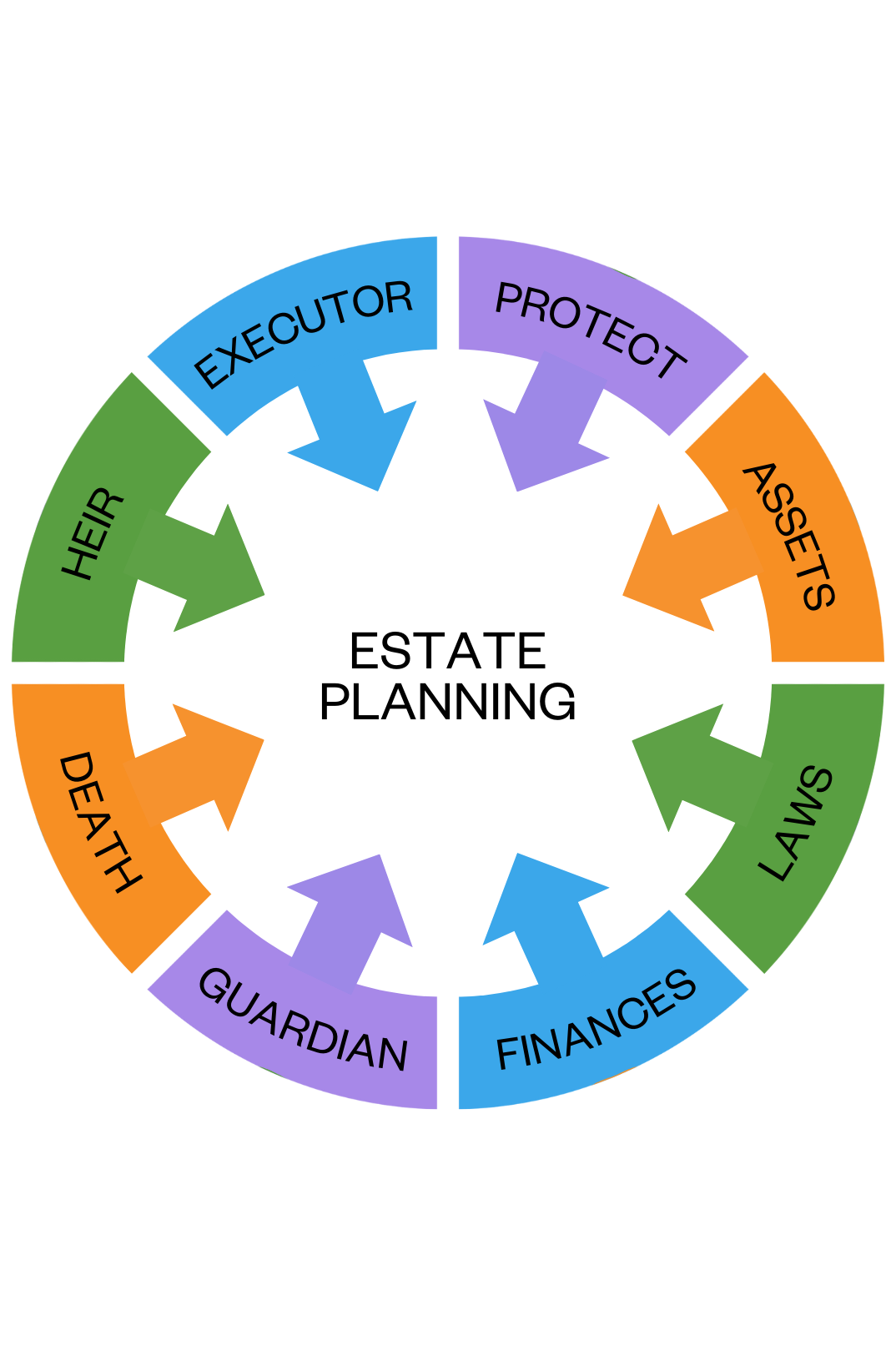

Estate Planning

The kindest thing you can give your family is peace of mind. Estate planning is a part of a financial plan that many people don’t know about or have limited information on.

Writing a will is a core component of estate planning and should be a part of your own customised holistic financial plan.

A will is a written document that outlines your instructions and preferences for the distribution of your estate (which includes your money, property, possessions, and other assets) after your death. A will can be either a simple statement or a more detailed document.

Writing a will is quite necessary if you have dependents, such as small children, children with disabilities, or elderly parents.

Your will might be as straightforward or complex as you’d like it to be. It contains your instructions for who you want to care for your minor children or elderly parents, as well as how you want your inheritance to be distributed after you pass away.

In a trying moment, this makes the process of settling your estate for your loved ones much simpler and less stressful. Having a will ensures that your preferences will be carried out without any complications.

If you die ‘intestate’ that is, without a proper will, you have no say in who will receive the assets you have carefully built up and they will be distributed in accordance with the law of the land, and that may not be to your spouse and children. You also get no say in who would be the legal guardians of minor children.

It is hard enough to lose your husband or wife, or parents, but a tough time is made harder still if there is no will to say who receives everything, especially if you get caught up in legal difficulties which can be costly and time-consuming, as well as very stressful.

A watertight will can also reduce taxes payable on death and, at the very least, you need to be aware of both the consequences of not doing it as well as the benefits.

We all want to leave the right legacy and take care of our loved ones and a properly written will allows you to do just that, even when you are no longer around.

Will Writing and Foreign Inheritance Laws

If you don’t have a will, your country’s inheritance laws will decide what happens to your assets. Chances are, this will not be in line with your wishes. If you are an expat or have assets overseas, there is more to consider when it comes to writing a will.

Wills in the UAE

Living abroad as an expat means that you will have to learn how the will writing system works in your country of residence. If you are an expat living in Dubai or Abu Dhabi, this section is for you.

Overcoming the Inheritance Taboo

Inheritance is a conversation that we would rather avoid. Is it time we stop looking at the topic of inheritance and estate planning as taboo? After all, the decisions you make in your will affect your loved ones.

Working with Shieraaj has been a game-changer for my Investment portfolio. His expertise and personalized approach helped me navigate complex financial decisions with confidence.

Build your financial legacy with me

Embark on a journey towards financial success with me. Your wealth knows no borders. Join me in shaping a prosperous future on a global scale.

Contact Me

UAE: +971 58 884 3622

South Africa: +27 (82) 426 8851